30+ How much will mortgage lend me

Common mortgage terms are 30-year or 15-year. Based on a standard repayment mortgage with an average interest rate of 25 and a term length of 25 years you should expect to pay roughly 1346 a month.

Writing A Breakup Letter Is The Most Convenient Way To Inform Your Girlfriend That You Are No More Interested I Break Up Letters Lettering Letters To Boyfriend

So for example if you want to buy a 500K house but there are 25000 worth of costs and you have 100K to contribute so you need to borrow 425000 then your LVR is 425500K.

. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. For instance a 400000 home loan could have a fee ranging from 2000 to. Although to fully know the amount you need to understand your kind of mortgage completely.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. With a capital and interest option you pay off the loan as well as the interest on it.

Virgin Money uses a range of calculations to work out how much applicants can borrow for a mortgage. Fill in the entry fields and click on the View Report button to see a. The easiest type to calculate is the fixed-rate because even if the term is for 30 years the.

A typical mortgage length is 25 years. Do you need to calculate how much deposit you will need for a 3000000 Mortgage. Using the calculator they found that Woolwich from Barclays will lend them a joint mortgage of 415000 - a whopping 188100 more than the loan RBS is prepared to offer the.

For this reason our calculator uses your. If your interest rate was. Mortgage Affordability Calculator.

The longer your term the less you may pay each month but youll end up paying more in interest. The mortgage should be fully paid off by the end of the full mortgage term. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

This would usually be based. If you qualify and if the rate is particularly good or you want to avoid the. So if you earn 30000 per year and the lender will lend four times this.

The maximum loan-to-income multiple of x449 applies to single and joint borrowers. With a home price of 400000 an 80000 down payment and a 4. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

The debt-to-income ratio which is also called the Back-End Ratio figures what. However some lenders allow the borrower to exceed 30 and some even allow 40. You may qualify for a loan amount of 252720 and your total monthly.

2049 lakh an interest rate of. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that. Interest rate The bigger your deposit the better the.

Capital and interest or interest only. The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loans total cost over the term. Lets say you are 3 years into a 30-year 500000 home.

Under this particular formula a person that is earning. Theyll give you an idea of how much you could borrow and see how changes to your mortgage could. This mortgage calculator will show how much you can afford.

AND YOU TELL ME HOW MUCH I WILL OWE. The first step in buying a house is determining your budget. If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest.

For example a person who is 30 years old and earns a gross monthly salary of 30000 rupees is eligible for a loan with a principal amount of Rs. There are two different ways you can repay your mortgage. You are applying for a new mortgage on your new property for the full amount you need to borrow.

DTI Often Determines How Much a Lender Will Lend. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. Our mortgage calculators and tools are designed to help make things easier for you.

Free Bill Pay Checklists To Easily Manage Your Payables Bill Pay Checklist Paying Bills Bill Payment Checklist

Funny Quotes Collections 30 Pics Husband Humor Funny Facts Quotes For Your Boyfriend

30 Free Infographic Templates For Beginners Venngage Free Infographic Templates Infographic Templates Infographic

Airbnb Superhost Bundle Etsy Airbnb Decorate Airbnb Airbnb House

How Federal Tapering Effects The Housing Market Economy Infographic Mortgage Interest Rates Mortgage Payoff

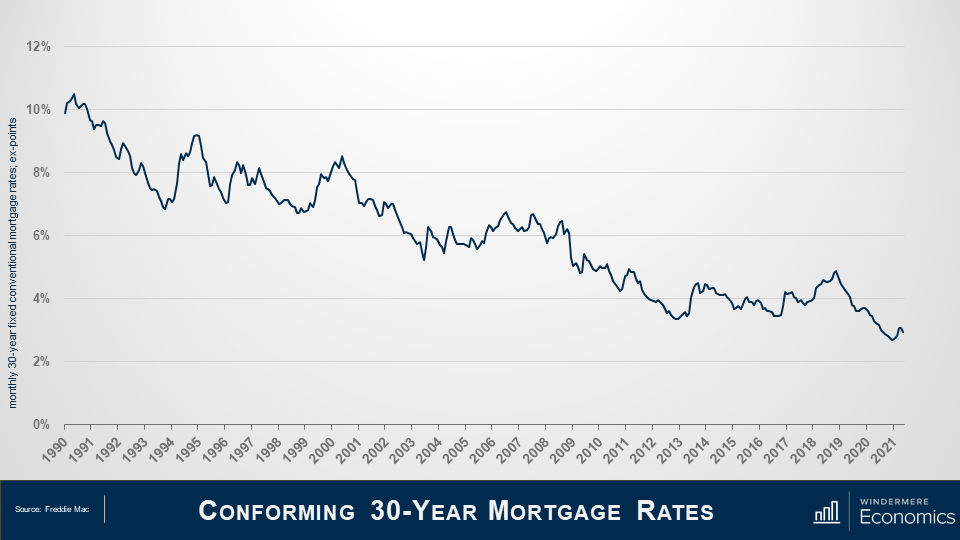

Why Are Interest Rates So Low

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

Pin On Airbnb

Feeling Unappreciated Inspirational Quotes True Quotes Love Quotes

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Should You Start Your Own Business Use This Flowchart To Find Out Infographic Marketing Blog For Small Businesses Webs Business Infographic Infographic Marketing Starting Your Own Business

6 28 21 Housing And Economic Update From Matthew Gardner Windermere Real Estate

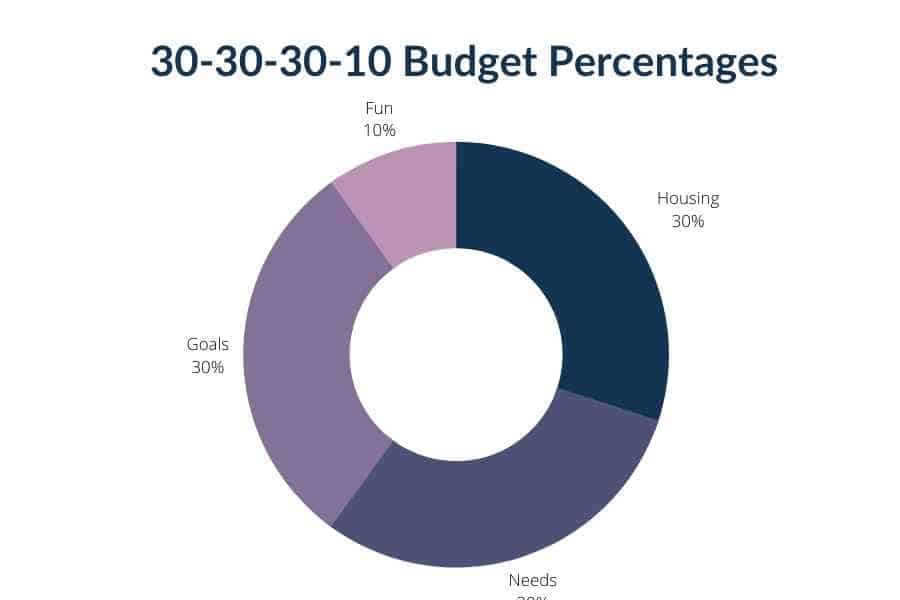

30 30 30 10 Budget Explained Pay Your Bills And Still Have Fun Boss Single Mama

Simple Loan Application Form Template New Top 5 Free Loan Agreement Templates Word Templates Word Template Contract Template Free Word Document

30 Flowchart Examples With Guide Tips And Templates Good Boss Management Skills Leadership Leadership Skills